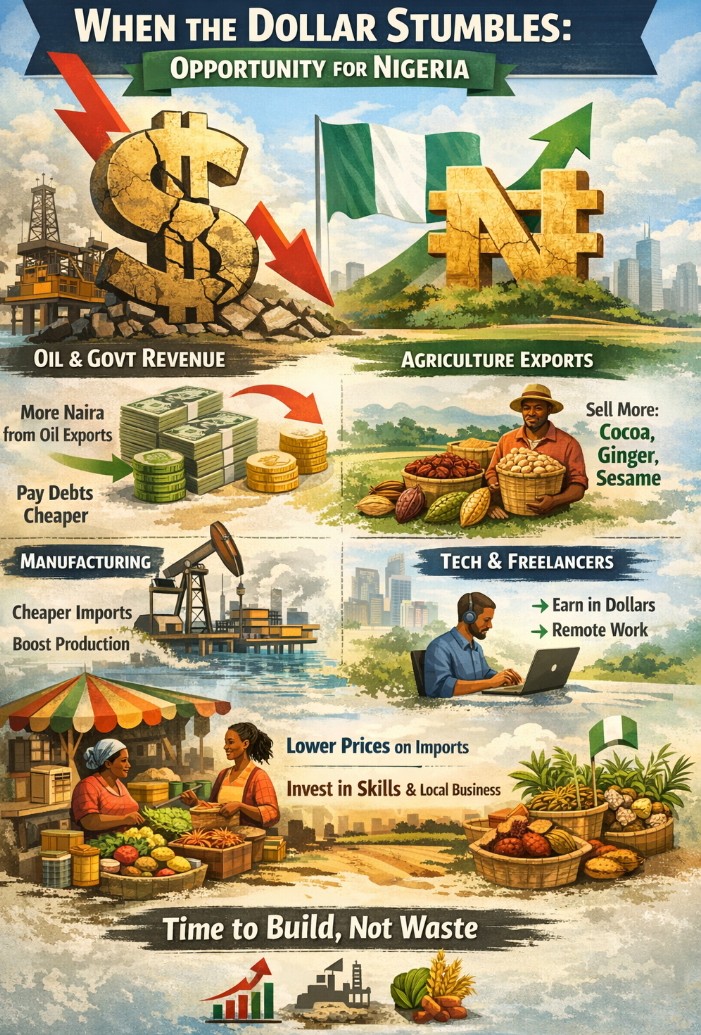

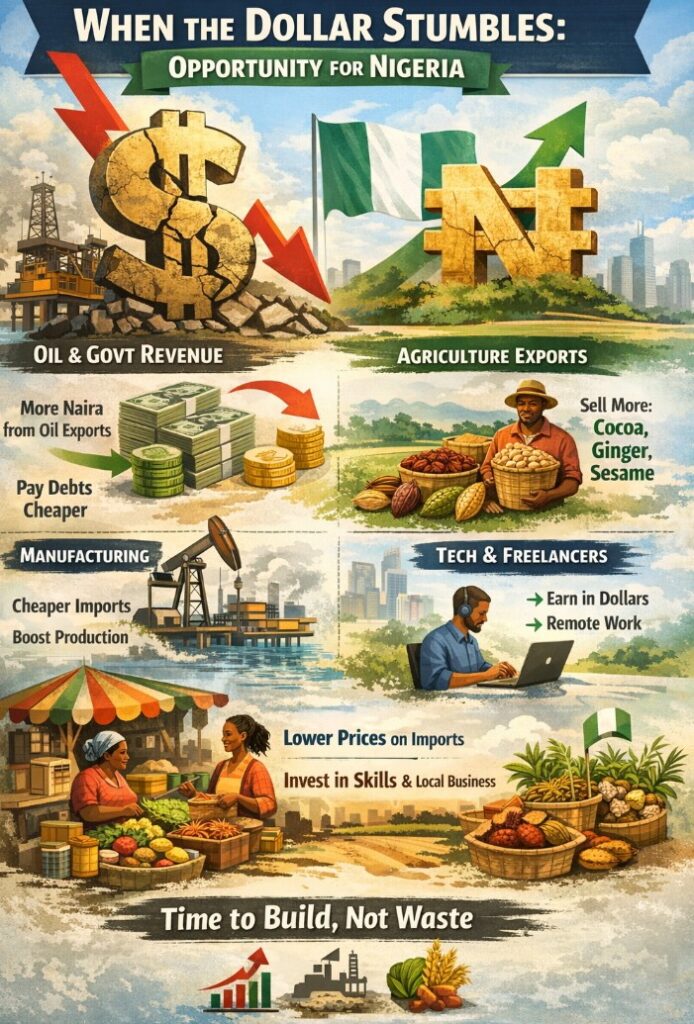

When the Dollar Stumbles: What a Weaker Dollar Really Means for Nigeria – and Who Can Win From It

In recent months, headlines have been filled with talk of the “falling dollar.” For many Nigerians, this sounds distant, technical, or even irrelevant. But the truth is simple: when the U.S. dollar weakens, it quietly reshapes economies around the world – and Nigeria is one of the countries that feels it most.

To understand why, imagine money as trading cards. The dollar is the most powerful card in the world. Nigeria’s naira is another card. When people say the dollar is falling, they mean that the dollar card is losing some of its strength. You no longer need as many naira cards to get one dollar card. The dollar is still strong, but it is not as dominant as it was before.

For Nigeria, this matters because the country earns most of its foreign money in dollars and spends a lot of money buying things from abroad using dollars. Any shift in the dollar’s strength creates both opportunities and risks.

So what exactly is happening, and who can benefit?

Why the Dollar Is Falling

The dollar’s current weakness is driven by global factors: changes in U.S. interest rates, rising government debt in the United States, and investors spreading their money across other currencies and assets instead of concentrating only on the dollar. This does not mean the dollar is collapsing. It simply means it is cooling off after years of extreme strength.

That cooling gives countries like Nigeria a small window of relief.

What This Means for Nigeria

When the dollar weakens, Nigeria may need fewer naira to buy one dollar. This can reduce pressure on the naira, slow down inflation, and make some imports slightly cheaper. It can also reduce the local currency cost of paying back dollar-denominated debts.

However, this relief is not automatic. The dollar falling is like rain falling from the sky. If Nigeria places buckets outside, it can collect water. If it places baskets, the water runs away.

Who Can Benefit – and How?

1. Government and the Oil Sector

Nigeria sells crude oil in dollars. If oil prices remain stable while the dollar weakens, government revenue in naira terms can improve. This creates room to pay debts, rebuild foreign reserves, and stabilize the economy. The key action here is discipline: plugging revenue leakages, improving oil production, and resisting wasteful spending.

2. Manufacturers and Industrial Players

Manufacturers that rely on imported machinery and raw materials can benefit from lower dollar pressure. This is a good time to upgrade equipment, expand capacity, and reduce production costs. Companies that move early can become more competitive locally and internationally.

3. Agriculture and Agro-Processing

This is one of Nigeria’s biggest opportunities. Export crops like cocoa, sesame, ginger, palm oil, and processed cassava products become more attractive in global markets. Farmers and agro-businesses that move beyond raw produce into processing and packaging can earn foreign exchange and create jobs. A weaker dollar gives Nigerian exports a better fighting chance.

4. Importers and Traders

For importers, restocking goods becomes less painful. Lower costs can improve profit margins or stabilize prices for consumers. Those who act fairly and avoid unnecessary price hikes will earn long-term customer trust.

5. Tech Workers, Freelancers, and Remote Professionals

Nigerians earning in dollars still benefit because the dollar remains stronger than the naira. At the same time, foreign companies often outsource more work to countries where costs are lower. Skilled Nigerians can benefit by increasing work volume, diversifying clients, and saving across currencies.

6. Banks and the Financial Sector

A weaker dollar can reduce panic demand for foreign exchange. Banks can support productive sectors like manufacturing, agriculture, and exports instead of focusing mainly on speculative trading. Stability, even if temporary, is an opportunity to rebuild confidence.

7. Everyday Nigerians

For ordinary people, the impact shows up in slower price increases, not instant price drops. This is a time to avoid panic buying of dollars, invest in skills, support local products, and spread savings wisely.

The Bigger Lesson

A falling dollar does not fix Nigeria. It only creates breathing space. Countries that use this moment to strengthen production, exports, and governance come out stronger. Countries that waste it return to crisis once the dollar regains strength.

The dollar stumbling is not Nigeria’s victory – it is Nigeria’s test. The real question is whether the country will use this moment to build real economic muscle or simply wait for the next shock.